2024 Tax Deductions And Credits

2024 Tax Deductions And Credits. The estimated tax deadlines for 2024 are: If you earned more than the social security payroll tax cap of $160,200 in 2023 ($168,600 in 2024), and paid the 6.2% social security tax on.

Deductions are applied before you calculate your taxes, while credits are applied to your final tax bill. Every year brings many changes to.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;.

Deductions Are Applied Before You Calculate Your Taxes, While Credits Are Applied To Your Final Tax Bill.

The standard deduction amounts for tax year 2023 are as follows:

January 16 (Q4 Payment Of 2023) April 15 (Q1 Payment Of 2024) June 17 (Q2 Payment Of 2024) September 16 (Q3 Payment.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you earned more than the social security payroll tax cap of $160,200 in 2023 ($168,600 in 2024), and paid the 6.2% social security tax on. That is why a trusted financial advisor can help you find every tax credit that.

Source: www.marketplacehomes.com

Source: www.marketplacehomes.com

New Standard Deductions for 2024 Taxes Marketplace Homes Press Release, 10%, 12%, 22%, 24%, 32%, 35% and 37%. 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund.

Source: lennaqevelina.pages.dev

Source: lennaqevelina.pages.dev

Federal Standard Deduction 2024 Audrye Jacqueline, For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;. In august 2022, president biden signed the inflation reduction act (ira) into law.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In august 2022, president biden signed the inflation reduction act (ira) into law. 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund.

![The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business](https://i.pinimg.com/originals/e2/0f/81/e20f81a96f10e2dc77a5e25a448ba22c.jpg) Source: www.pinterest.com

Source: www.pinterest.com

The Master List of All Types of Tax Deductions [INFOGRAPHIC] Business, That is why a trusted financial advisor can help you find every tax credit that. People should understand which credits and deductions they can claim and the records they need to show their eligibility.

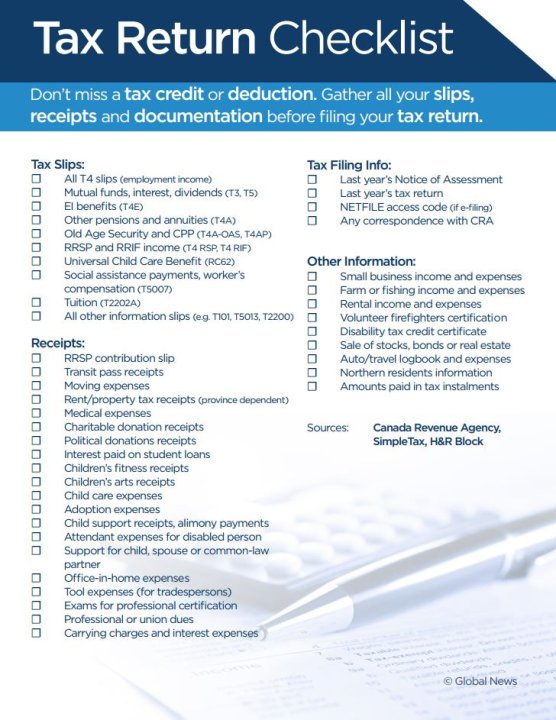

Source: globalnews.ca

Source: globalnews.ca

Filing your tax return? Don’t these credits, deductions, In august 2022, president biden signed the inflation reduction act (ira) into law. Navigating the world of tax credits and deductions can be confusing.

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, 4, 2024 — tax credits and deductions change the amount of a person’s tax bill or refund. For married couples who file a joint tax return, the 2024 income brackets and corresponding tax rates are as follows:

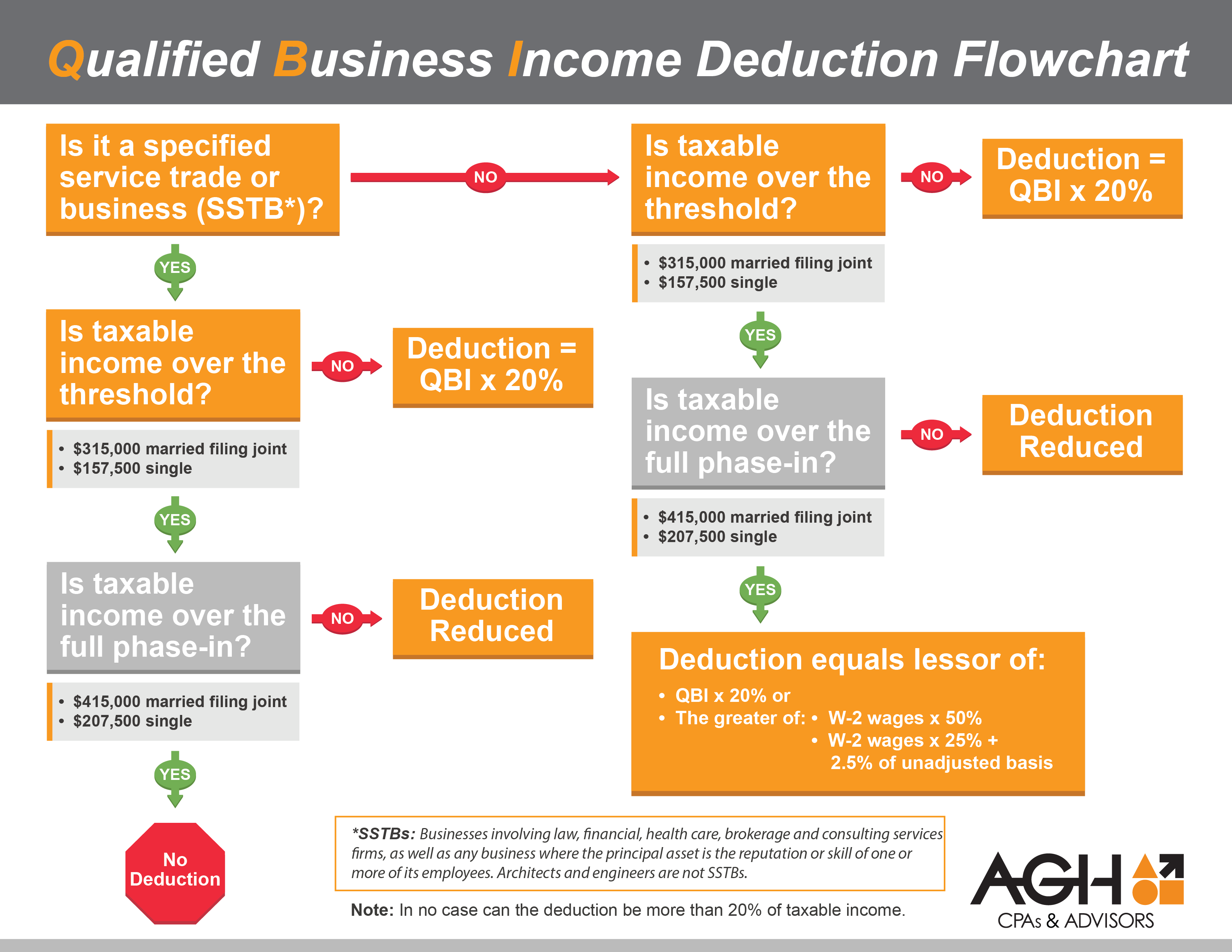

Source: www.businesser.net

Source: www.businesser.net

What Is The Deduction For Qualified Business businesser, Deductions, including the standard tax deductions 2024, lower your tax liability, potentially leading to a higher tax refund or a lower tax bill. Tax credits and deductions can be key to reducing what you.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, $13,850 for single taxpayers or couples filing separately, under 65 years of age. 2024 tax season guide on new tax credits, deductions for small businesses.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Federal Tax Withholding Tables For Employers Matttroy, That is why a trusted financial advisor can help you find every tax credit that. The estimated tax deadlines for 2024 are:

Knowing Which Deductions Or Credits To Claim Can Be Challenging, So We Created This Handy List Of 53 Tax Deductions And Tax Credits You Can Take In.

Navigating the world of tax credits and deductions can be confusing.

But With Even A Rudimentary Understanding Of The 2024 Tax Brackets, You Can Make Better Decisions About Retirement Contributions, Deductions And.

The 2024 tax year features seven federal tax bracket percentages: